November 2020 – FPA SoCo Chapter Virtual Event – Post Election Economic Outlook

Learning Objectives:

- Where is COVID‐19 heading in terms of the economy

- What will policy look like post‐election

- What are the Fed’s next moves

- How to position portfolios in a low interest rate environment

CE Credit: 1 CFP CE Credit available!

Speaker: Brian Quinn, Guggenhiem Investments— Mr. Quinn is a Product Specialist on Guggenheim Partners’ Product Development and Management team, responsible for covering Guggenheim’s active fixed income strategies. He joined Guggenheim in 2017. Prior to joining Guggenheim, Mr. Quinn was a Portfolio Specialist for Newton Investment Management, a BNY Mellon company, covering multi‐asset absolute return and global equity strategies. He also spent two years serving as the Regional Team Lead on BNY Mellon’s Mutual Fund sales desk. He started his career at Credit Agricole Corporate & Investment Bank in New York, focusing on corporate advisory and origination of IPOs, Convertible Bonds, and Share Buybacks. Mr. Quinn earned a B.S. in Finance and Leadership from Boston College’s Carroll School of Management. He has earned the right to use the CAIA designation and is a member of the CAIA association, and was involved in forming the association’s latest curriculum.

Speaker: Brian Quinn, Guggenhiem Investments— Mr. Quinn is a Product Specialist on Guggenheim Partners’ Product Development and Management team, responsible for covering Guggenheim’s active fixed income strategies. He joined Guggenheim in 2017. Prior to joining Guggenheim, Mr. Quinn was a Portfolio Specialist for Newton Investment Management, a BNY Mellon company, covering multi‐asset absolute return and global equity strategies. He also spent two years serving as the Regional Team Lead on BNY Mellon’s Mutual Fund sales desk. He started his career at Credit Agricole Corporate & Investment Bank in New York, focusing on corporate advisory and origination of IPOs, Convertible Bonds, and Share Buybacks. Mr. Quinn earned a B.S. in Finance and Leadership from Boston College’s Carroll School of Management. He has earned the right to use the CAIA designation and is a member of the CAIA association, and was involved in forming the association’s latest curriculum.

When: Friday, November 20th

Time: 12:00pm Mountain Time (US and Canada)

Location: Zoom–please see the email sent out on November 9th for Zoom details–click on the provided link at 11:55am on November 20th.

October 2020 – FPA SoCo Chapter Virtual Event – Medicare Concepts For Today’s Advisors

Learning Objectives:

- Learning Objectives:

- History of Medicare

- What does Medicare cover

- When do clients sign up for Medicare

- What do your clients pay for Medicare

- Beyond Medicare – Part C & Part D

- Medicare Advantage

- Medicare Supplemental

- Helping w/ Pro Bono -Making a difference in the community we serve

- Have a Plan with your Medicare customers

CE Credit: This program does not qualify for CFP CE Credit

Speaker: Bruce Lindsay– As Market Manager of Colorado Central for UnitedHealthcare, Bruce Lindsay is responsible for managing the Medicare Solutions portfolio to help seniors live a healthier life. Bruce is an 11-year veteran of the insurance industry, specializing and leading sales team. He finds it a privilege to help listen, guide, and teach medicare beneficiaries their options to ensure they choose the right plan for coverage. Bruce earned a BS degree at the University of Wisconsin-Platteville. As Market Manager of Colorado Central for UnitedHealthcare, Bruce Lindsay is responsible for managing the Medicare Solutions portfolio to help seniors live a healthier life. Bruce is an 11-year veteran of the insurance industry, specializing and leading sales team. He finds it a privilege to help listen, guide, and teach medicare beneficiaries their options to ensure they choose the right plan for coverage. Bruce earned a BS degree at the University of Wisconsin-Platteville.

Speaker: Bruce Lindsay– As Market Manager of Colorado Central for UnitedHealthcare, Bruce Lindsay is responsible for managing the Medicare Solutions portfolio to help seniors live a healthier life. Bruce is an 11-year veteran of the insurance industry, specializing and leading sales team. He finds it a privilege to help listen, guide, and teach medicare beneficiaries their options to ensure they choose the right plan for coverage. Bruce earned a BS degree at the University of Wisconsin-Platteville. As Market Manager of Colorado Central for UnitedHealthcare, Bruce Lindsay is responsible for managing the Medicare Solutions portfolio to help seniors live a healthier life. Bruce is an 11-year veteran of the insurance industry, specializing and leading sales team. He finds it a privilege to help listen, guide, and teach medicare beneficiaries their options to ensure they choose the right plan for coverage. Bruce earned a BS degree at the University of Wisconsin-Platteville.

When: Friday, October 30th

Time: 12:00pm Mountain Time (US and Canada)

Location: Zoom–please see the email sent out on October 25th for Zoom details–click on the provided link at 11:55am on October 30th.

September 2020 – FPA SoCo Chapter Virtual Event – An Asset Repositioning Story for Funding Retirement Longevity

Program Description: Understanding what retirees want and what keeps them up at night remain critical elements for financial professionals to solve for retirees. In this session, presented at FPA Annual Conference 2019, planners will learn about the myths and biases that surround these questions and how to protect retirement income that mitigates longevity risk. Mitigating longevity risk is an asset relocation story. Building asset location that creates both promised based and market based income sources that create a safe withdrawal rate from market based assets and a base level of income that cannot be destroyed or outlived. High priorities include income flow, discretionary liquidity, growth opportunities and legacy goals.

Presentation Learning Objectives:

- Differentiate between asset allocation and asset relocation

- Compare Promised Based vs. Market Based income solutions

- Explain longevity risk and methods of asset relocation that mitigate this risk while providing superior income and growth outcomes

Approved for 1 CFP CE Credit!

Speaker: Curtis V. Cloke is an award-winning international speaker, educator and author as a retirement expert. His presentations are entertaining, inspirational and educational. Curtis serves as an Adjunct Instructor for The American College of Financial Services as part of the educational team of experts who helped develop curriculum and content for the new online RICP (Retirement Income Certified Professionals) designation program. In 2009, Curtis was also recognized as a top five finalists for “Advisor of the Year” by Senior Markets Advisor Magazine. Lastly, he develops retirement software for the industry and has a deep knowledge of the math and science.

When: Friday, September 25th

Time: 12:00pm Mountain Time (US and Canada)

Location: Zoom–please see the email sent out on September 18th for Zoom details–click on the provided link at 11:55am on September 25th.

August 2020 – FPA SoCo Chapter Virtual Event – Why Optimizing Social Security Benefits Is Still A Very Complicated Proposition

Program Description: After discussing Social Security rule changes in November 2015, the presenter will present 10 reasons why it is still complicated to determine when clients should claim their benefits. There are now two sets of rules depending upon date of birth and with the SSA’s use of strange dating features, many new retirees have different full retirement ages for retirement and spousal benefits than for survivor benefits. In this course, presented at FPA Annual Conference 2019, learn about clients options to redo a prior claiming decision and other complications around claiming strategies for widow(er)s younger than 70, for earnings tests, children’s benefits, divorced benefits, disability benefits, and especially pensions from work not covered by Social Security.

Presentation Learning Objectives:

- Describe recent rule changes and strategies related to Social Security changes specifically new rules around date of birth

- Explain the rules affecting and claiming strategies related to earnings tests, children’s benefits, divorced benefits, disability benefits, and survivor benefits

- Define how the WEP and GPO affect benefits for clients that receive a pension from a job not covered by Social Security and their spouses

Approved for 1 CFP CE Credit!

Speaker: Dr. William Reichenstein, CFA, is the Head of Research at Social Security Solutions, Inc. and Retiree, Inc. He is Professor Emeritus at Baylor University. He has published more than 190 articles and several books including Social Security Strategies, 3rd Edition, with William Meyer.

When: Friday, August 28th

Time: 12:00pm Mountain Time (US and Canada)

Location: Zoom–please see the email sent out on August 6th for Zoom details–click on the provided link at 11:55am on August 28th.

July 2020 – FPA SoCo Chapter Virtual Event – Investigating The Role Of Whole Life Insurance In A Lifetime Financial Plan

Program Description: This presentation, from FPA Annual Conference 2019, goes into greater depth about two retirement income approaches: using an aggressive investment portfolio to seek greater returns through the risk premium, and using an integrated strategy for investments with life insurance and annuities to seek greater returns through risk pooling. My research finds that risk pooling tends to be underappreciated as a unique source of returns that is unavailable for an investment portfolio in which the retiree aims to self-manage longevity and market risk through conservative spending.

Presentation Learning Objectives:

- Differentiating between accumulation and distribution

- Understanding key retirement risks

- Surveying the retirement tool landscape with respect to investments and/or insurance

Approved for 1 CFP CE Credit

When: Friday, July 24th

Time: 12:00pm Mountain Time (US and Canada)

Location: Zoom–please see the email sent out on July 8th for Zoom details–click on the provided link at 11:55am on July 24th.

June 2020 – FPA SoCo Chapter Virtual Event – Having Difficult Conversations with Clients – The Basics of Behavioral Coaching

Program Description: In this presentation, designed especially by and for financial planners, FPA has partnered with the Financial Therapy Association to offer education that will help practitioners effectively work with clients through the most commonly identified life changing situations. Created by a financial therapy experts and financial planners, the series focuses on three different emotional events, detailing researched therapeutic techniques and case studies that any financial planner can use immediately in their practice. Gain a deeper understanding of behavioral coaching, the Vanguard Advisor’s Alpha tenet that can provide the most value for your clients. Learn why consumers’ typical, ratings-driven approach to decision-making does not translate well to the investment world. We will discuss the value you add as an effective behavioral coach and how Vanguard can help. Emphasis is placed on the importance of the financial plan and the emotional circuit-breaker role that advisers can play for their clients.

Approved for 1 CFP CE Credit

When: Friday, June 26th

Time: 12:00pm Mountain Time (US and Canada) – Join at 11:45am for a quick catch-up prior to the meeting start

Location: Zoom–please see the email sent out on June 12th for Zoom details–click on the provided link at 11:45am on June 26th.

May 2020 – FPA SoCo Chapter Virtual Event – Reaching The Aging Baby Boomer: Making The Transition From Financial Planning to Longevity Planning

Program Description: As baby boomers age and experience extended longevity they will be demanding more from their financial planners. This session, recorded at the 2019 FPA National Conference, will focus on the issues and concerns that older adults confront and what financial planners must know in order to address and effectively meet their needs. Participants will come to better understand the necessity of offering longevity planning, including long term care and legacy planning as well as inter-generational communication and preparation for end-of-life decisions.

Approved for 1 CFP CE Credit

When: Friday, May 29th

Time: 12:00pm Mountain Time (US and Canada)

Location: Zoom–please see the email sent out on May 15th for Zoom details–click on the provided link at 11:55am on May 29th.

April 2020 – FPA SoCo Chapter Virtual Event – Best Practices To Help Your Brand During COVID-19

Program Description: This virtual offering by your local FPA Chapter will explore the best ideas being utilized to deal with the current social-distancing practices. You’ll hear good advice from members of the Chapter Board in a discussion moderated by Craig Carnick, CFP. If you have specific questions or topics of concern, send an e-mail to [email protected] ASAP, and your specific areas will be addressed.

When: Friday, April 24th

Time: 11:00am Mountain Time (US and Canada)

Location: Zoom–please see the email sent out on April 15th for Zoom details–click on the provided link at 10:55am on April 24th.

Canceled

March 2020 – FPA SoCo Chapter Event – How Advisors Can Help Their Clients Achieve Retirement Success

1 CFP Credit Opportunity

Here is another opportunity to earn a CFP Credit featuring Nathan Johnson.

Program Description: Leading retirement researchers have concluded that today’s reverse mortgages, both government-insured and proprietary, can improve a client’s retirement portfolio income efficiency, retirement sustainability, and their legacy. Attendees will receive a detailed analysis of the impact a Reverse Mortgage has on a plan will be demonstrated in MoneyGuidePro, eMoney, and Right Capital. Advanced planning strategies like voluntary mortgage payments on a reverse mortgage can provide funding for longevity or long-term care. Additionally, attendees will learn how to incorporate home equity into their clients’ holistic financial plans, and how to create reverse mortgage solutions that are tailored to individual client needs.

Upon completion of the program, attendees will be able to:

- Educate older clients on the basics of the FHA-insured* reverse mortgage (HECM) and new Portfolio Program offerings, as well as clearly present the pros and cons of reverse mortgages.

- Understand how incorporating a HECM into a financial plan can positively affect client outcomes.

- Explain to older clients the various uses of a reverse mortgage to help support their retirement expenses through income-tax-free funds†, i.e. line of credit, tenure payments, refinancing an existing mortgage and/or purchasing a new home.

- Identify what financial strategies should not include a HECM and which clients should avoid HECMs in their retirement planning.

- Determine suitable timing for older clients to employ a HECM as part of their retirement planning. .

- Earn 1 CFP CE credit

When: Friday, March 27th

Time: 11:30 am

Location: Integrity Wealth Advisors office located at 13540 Meadowgrass Drive, COS, 80921.

Please RSVP directly to [email protected] by End of Business on Tuesday, March 24th.

Nathan Johnson is a team lead in the Financial Planner Education Channel for the largest Ginnie-Mae Issuer of HECM Mortgage Backed Securities in the Reverse Mortgage Industry. With 12 years of industry experience in the retirement income planning space, Nathan has built a career on using proven strategies that provide increased cashflow, decreased risk, and increased legacy value. His ability to communicate advanced planning strategies in an easy to learn format helps many advisors connect the dots between the academic research of Pfau, Kitces, and Evansky with the four most common uses of a reverse mortgage among planners. Although Nathan primarily works with fee-based and fee-only planners, any advisor will find his strategies helpful for their retiree clients.

February 2020 – FPA SoCo Chapter Event – Annuities – So Much More Than Income!

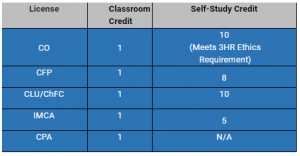

Unique CE Credit Opportunity!

Here is another opportunity to earn CE Credits that you do not want to miss presented by Bill Gaffney with Lincoln Financial!

Spend two hours at this FPA Meeting/Workshop and earn ALL of the following!

In a special arrangement with Lincoln Financial and the Success Continuing Education Company you can earn all these CE Credits just by attending the special 2-hour February meeting of the FPA of Colorado Springs.

- Here’s what you need to do: Download the PDF linked here and follow the directions to register for this workshop

- Once you register, you’ll then be able to download the pre-study materials for the workshop

- Arrive at 11:30am for the included lunch–no charge for members or first time guests

- Attend the class from 12-1pm and earn the minimum CE, 1-hour as shown above

- Discuss the material and take the exam from 1-2pm

- Score at least 70% on the exam and you take home all your Colorado Insurance Ethics Requirements plus CFP and/or CLU/ChFC CE Credits as shown above

Workshop Title: Annuities – So Much More Than Income

- Recognize the risks individuals face when nearing or preparing for retirement, including longevity risk, withdrawal rate risk, market risk, tax risk, and inflation risk

- Identify the various types of annuities–from fixed annuities, to variable annuities, to fixed indexed annuities, to hybrid annuities

- Identify problems that are presented, and how the right annuity structure can fulfill those goals and solve those problems

When: Friday, February 28th

Time: 11:30am – 2pm

Location: Integrity Wealth Advisors office located at 13540 Meadowgrass Drive, COS, 80921.

Please RSVP directly to [email protected] by End of Business on Tuesday, February 25th!

Bill Gaffney – Bill joined the Lincoln Financial Relationship Management team in June 2017 and has five years of experience in the financial services industry. In his current capacity as CE Training Specialist Bill supports business development, marketing, sales, and B2B initiatives for life insurance, annuities, long-term care, and retirement solutions for Lincoln’s Strategic Partner firms. Prior to this position, Bill was an Internal Wholesaler at Pacer ETFs, where he supported 3 states in the distribution of ETF sales. Bill holds FINRA Series 7 and 63 registrations, and state life and health licenses. He received a BS in Business Management from West Chester University. In his free time, Bill enjoys his playing Golf, Ice Hockey, and enjoying time with his family.

January 2020 – FPA SoCo Chapter Event – Seven Principles for Generating Retirement Cash Flows

1 CFP Credit Opportunity

Here is another opportunity to earn a CFP Credit featuring Ben Rizzuto of Janus Henderson Investors.

Ben will be here to provide a comprehensive overview of information that clients and their advisors should consider when planning income solutions for retirement. This program touches on:

- Cash Flow Consolidation

- Portfolio Segmentation

- Maximizing Social Security Benefits

- Taxation in Retirement

- Common Pitfalls of Investing Solely for income

When: Friday, January 24th

Time: 11:30 am

Location: Integrity Wealth Advisors office located at 13540 Meadowgrass Drive, COS, 80921.

Please RSVP directly to [email protected] by End of Business on Wednesday, January 22nd.

Ben Rizzuto, CFP is a Retirement Director for Janus Henderson Investors. In this role, he works with financial advisors, platform partners, Janus Henderson colleagues, and clients to find solutions to today’s increasingly difficult retirement issues. Ben also contributes to the dialogue surrounding these issues as host of the Plan Talk podcast and through periodic posts to the Janus Henderson Blog. Prior to joining Janus in 2014, he worked as a business development consultant for Jackson National Life, where he helped financial advisors grow their fee-based practices.

Ben received his BA degree in political science from the University of Colorado – Boulder and an International MBA with concentrations in finance and Italian from the University of South Carolina, Darla Moore School of Business. He holds FINRA Series 7 and 66 securities licenses and the Chartered Retirement Plans Specialist (CRPS®) designation. He has 15 years of financial industry experience.

October Event – Everything You Need To Know About The New CFP Rules

On Friday evening, October 18, the Colorado Springs Chapter of the Financial Planning Association will present a 1-hour program featuring noted speaker Jeff Rattiner who will provide everything you need to know about the new CFP Ethics rules. If you’re confused, unsure or just plain ignorant of the new requirements that will go into effect in the next 60 days, this session is for you!

Date: Friday, October 18

Time: Program at 6:00, Dinner at 7:00

Cost: Members are FREE for program and dinner and wine,

non-members @ $100

Location: Marigolds Restaurant 4605 Centennial Blvd 599.4766

RSVP: Please RSVP to [email protected] ASAP!

Jeff Rattin er educates financial advisors on how they can prepare for the CERTIFIED FINANCIAL PLANNER™ (CFP®) Certification Examination in a boot camp format through his nationally recognized and acclaimed “Rattiner’s Financial Planning Fast Track®” (FPFT) program. FPFT has won critical acclaim as the cover story in Financial Planning Magazine and The Register. His lively and entertaining teaching style has served professionals well for over 28 years. His classes have been held at New York University, The American College, University of California, Metropolitan State College of Denver, The Ohio State University and Arizona State University, and at dozens of financial service companies. He was awarded the “1997 Distinguished Faculty Member-Teacher of the Year” by Community College of Denver. Mr. Rattiner has been a long-time featured speaker to many of the largest financial services companies, CPA firms, consumer companies, and professional financial advisor audiences nationwide. He provides keynote and breakout sessions at conferences, daily corporate in-house training, professional continuing education, consultative services, and one-on-one coaching.

er educates financial advisors on how they can prepare for the CERTIFIED FINANCIAL PLANNER™ (CFP®) Certification Examination in a boot camp format through his nationally recognized and acclaimed “Rattiner’s Financial Planning Fast Track®” (FPFT) program. FPFT has won critical acclaim as the cover story in Financial Planning Magazine and The Register. His lively and entertaining teaching style has served professionals well for over 28 years. His classes have been held at New York University, The American College, University of California, Metropolitan State College of Denver, The Ohio State University and Arizona State University, and at dozens of financial service companies. He was awarded the “1997 Distinguished Faculty Member-Teacher of the Year” by Community College of Denver. Mr. Rattiner has been a long-time featured speaker to many of the largest financial services companies, CPA firms, consumer companies, and professional financial advisor audiences nationwide. He provides keynote and breakout sessions at conferences, daily corporate in-house training, professional continuing education, consultative services, and one-on-one coaching.

August FPA SoCo Chapter Event – CE Credit Opportunity

Here is another opportunity to earn CE Credit featuring a live presentation by Melissa Tosetti, is the Founder of The Savvy Life & author of the international bestseller, Living The Savvy Life.

Melissa will be here to discuss The Power of Cash Flow Planning for your clients and ways she works as an outside resource for Financial Advisors.

When: Friday, August 23rd

11:30-12:00 Lunch/Networking

12:00 – 1:30 Presentation

Location: Integrity Wealth Advisors office located at 13540 Meadowgrass Drive, COS, 80921.

Please RSVP directly to [email protected] by End of Business on Tuesday, August 22nd for lunch, or by Thursday, August 24th for the presentation only.

September Luncheon Program

CRYPTOCURRENCIES & BLOCKCHAIN – JOSH BROWN, RITHOLTZ WEALTH MANAGEMENT & CNBC

Be Prepared to Answer Your Clients’ Questions About Cryptocurrencies!

Cryptocurrencies are paradigm changers in the financial world. They depend on blockchain technology, which automatically sends an up-to-date copy of a database or ledger to each computer in the blockchain network, creating a shared source of information where once entered, a transaction cannot be changed. Josh Brown will help us explore the potential risks and rewards of cryptocurrencies.

Joshua Brown is the CEO of Ritholtz Wealth Management, a New York City-based investment advisory firm where he helps people invest for the future. He has been named by The Wall Street Journal, Barron’s and TIME Magazine as the most important financial follow on Twitter. Josh’s blog, The Reformed Broker, is read by millions of investors, traders and advisors around the world. He is also the author of the books Backstage Wall Street and Clash of the Financial Pundits. His investment advisory firm, based in New York City, is focused on financial planning, retirement solutions, and institutional asset management.

Learning Objectives:

- Understand the history and relevance of cryptocurrencies and digital assets for wealth management

- Learn what’s involved in use, adoption and ownership of digital assets

- Learn how things are evolving in technology and regulatory changes

- Understand how to answer clients’ questions and address their concerns about emerging investment opportunities

We’ll also discuss how cryptocurrencies may evolve, and Josh will provide resources to help you learn more and stay abreast of current trends.

Friday September 28, 2018

12pm – 1:30pm

12:00: Presentation, expected to provide 1.0 CFP CEs, 1.0 insurance CEs

Lunch and CE Credit are provided at no cost to members

$20 charge for non-members.

Location:

Integrity Wealth Management

13540 Meadowgrass Drive, suite #100

Colorado Springs, CO 80921